Just after the Conservatives’ latest emergency budget, in which they managed to raise taxes to record heights, @CutMyTaxUK, a low-tax campaign I’m helping, tweeted an explanation of why Labour could become the low-tax party and wipe out the Conservatives.

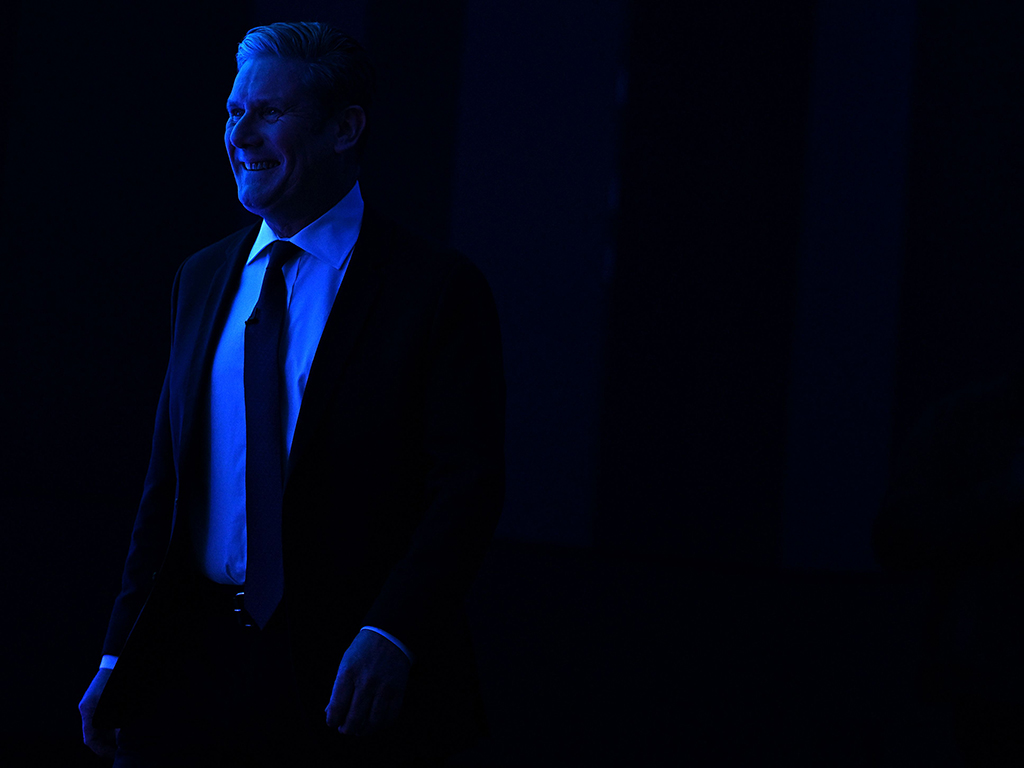

Some of my Labour-supporting friends retweeted it and just a week later up pops Sir Keir Starmer in the Telegraph suggesting Labour will indeed cut taxes. “I want taxes to come down for working people. They’ve been really clobbered time and time again, whether that’s on income tax, whether it’s National Insurance or council tax,” he said. “The highest tax since the Second World War – this really is anti-Conservative stuff,” he helpfully pointed out.

Indeed, it’s worth noting that it is not set in stone that progressive parties have to be high-tax parties. In the US in the 1960s JFK’s Democrats pushed through deep cuts to marginal tax rates in the face of strong opposition from the Republicans. In the 1980s New Zealand’s Labour Party replaced the Conservative Robert Muldoon’s five rates of income tax (of which the highest was 66 per cent) with just two, 24 per cent and 33 per cent, and cut the company tax rate from 48 per cent to 33 per cent. The economy boomed as a result. In 2005 the ruling Social Democratic Party in Sweden, supported by the Green Party and the Left Party, agreed to repeal inheritance and gift tax altogether. They did so and have opposed its reintroduction ever since.

And of course in the UK we have the example of the Blair and Brown governments. They were not high-tax governments, as Tony Blair himself made clear in an appearance on Question Time: “I don’t think that the answer… is to take some money off those at the top and give a few more pounds in benefit to those at the bottom.” In 1998 Labour cut capital gains tax and further cuts followed. By 2000 the rate for business assets held for four years was only 10 per cent.

Becoming a low-tax party would have many advantages for Labour, cutting the Conservatives off at the knees being the most significant political one. More importantly it could create the economic growth that could keep Labour in power for a generation. The alternative strategy of further increases in taxes has the flaw that little extra revenues can in practice be raised. With taxes at a 75-year high, behavioural responses to further tax rises would probably wipe out any gain.

To be consistent, Starmer’s tax cuts would have to be for everyone, including the almost 20 per cent of taxpayers who now pay the higher or additional rate. His reference to tax cuts “for working people” is slightly alarming. If Labour is to convince voters it is serious about cutting taxes it, surely it needs to show that the 1 per cent of taxpayers who pay 30 per cent of income tax revenues are also considered “working people”.

If he did, an electoral competition between a declinist Brownite Conservative Party and an optimistic tax-cutting Blairite Labour Party would only have one result. The Conservatives would be wiped out.

[See also: Rishi Sunak and Keir Starmer have capitulated to the Brexit zealots]