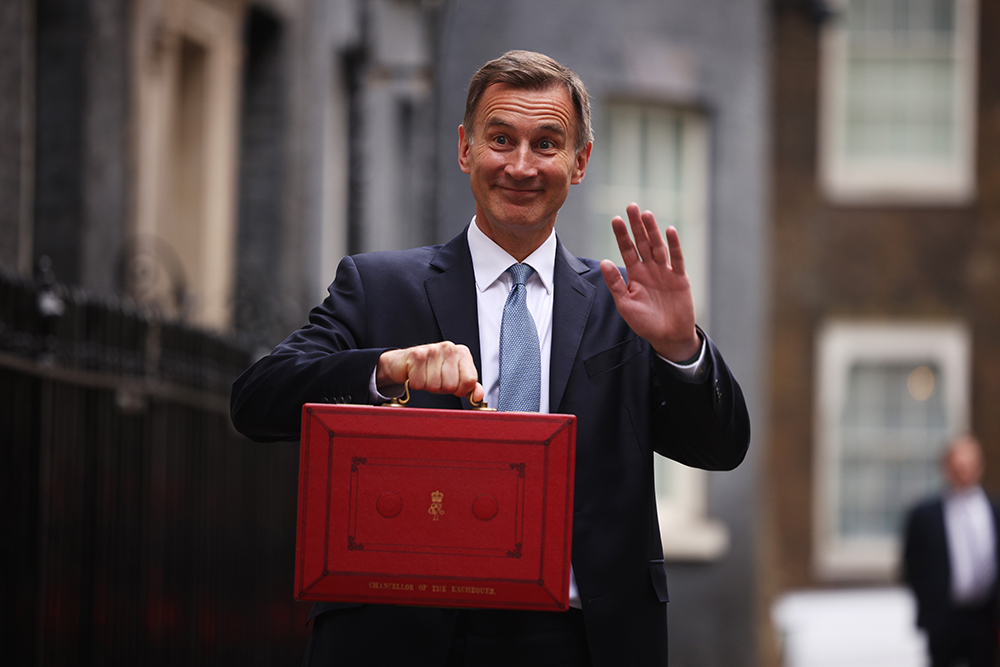

When Jeremy Hunt presented his Budget speech to the Commons on 15 March, he made repeated mention of the “declinists” who unhelpfully (and in his view, wrongly) assert that Britain’s economy has been in some way harmed by 13 years of Tory rule. I naturally assumed that he was talking about the New Statesman’s business and economics newsletter, the Crash (which you can receive weekly by signing up here), or perhaps the International Monetary Fund or the OECD, but the true identity of these mysterious “declinists” who are undermining our great country is becoming apparent: they’re British consumers, who stubbornly decided to buy even less in the two weeks after the Budget than they had before it.

New data released by Adobe, which provides the software behind much of our online spending, finds that in advance of the Budget consumer spending online was 6.6 per cent less than the same period the previous year – but in the two weeks after the Budget, the gap widened still further to 13.9 per cent below 2022.

Vivek Pandya, lead analyst at Adobe Digital Insights, told me: “We don’t usually see massive inter-week drops” in consumer spending online, and that the fall immediately after the Budget was “significantly unusual”.

This might seem counterintuitive, given that the Budget was accompanied by genuinely good news: the Office for Budget Responsibility forecast that Britain would narrowly avoid recession this year. The second half of March also contained the month’s big shopping event, Mother’s Day (19 March), which might have been expected to boost sales (those extra flowers and cards might still appear in physical retail spending).

[See also: A boring Budget is a dangerous Budget]

What the online data shows, Pandya said, is that “consumers aren’t like a rubber band, where you’ve got a bit of rosy news and now all of a sudden, they’re ready to spend. They’ve weathered quite a bit, over the past couple of years.” Pandya said he sees online sales as a “strong leading indicator” of what’s happening in the economy because the data gives “a really precise view of the consumer pricing pressure that’s being experienced”.

Adobe’s data also indicates that of the spending that is happening, a record amount (14 per cent of all e-commerce) is being funded by buy now, pay later (BNPL) schemes such as Klarna. These short-term, interest-free (if you pay them off on time) loans have become popular among younger shoppers for buying clothes and consumer electronics, but Pandya said they’re increasingly used to fund grocery shopping. I’d argue a leading indicator of concern in an economy is large numbers of people taking out short-term loans to buy food.

The most fundamental issue is that, overall, people are spending more and buying less. Harvir Dhillon, an economist at the British Retail Consortium, believes that the more general picture from their data is “a bit of an uptick” in consumer confidence, but that this is the return from historic lows. “There’s still some anguish about the wider economic context. Despite the potentiality that we will avoid a technical recession, there is the inescapable reality that for many, it does feel like a recession.”

The inflation basket is not homogeneous, Dhillon said, and while some categories such as fuel have seen a bit of welcome relief in prices, “There’s a big chunk of the consumer basket that’s still seeing price increases, month on month. So it’s clearly having a dampening effect on how consumers are feeling.”

Perhaps people will feel more optimistic by the middle of next month, when inflation will fall sharply – not because the government has done anything about it, but because it’ll have been a full year since Ofgem raised its price cap, which means the biggest hike in prices won’t be part of the 12-month calculation any more. But prices will still be rising, almost certainly faster than wages. Those in Downing Street may congratulate themselves, but don’t expect the rest of us to join in.

Read more:

What does the Budget mean for levelling up?

Jeremy Hunt’s Budget is too late

The Budget showed Rishi Sunak is trapped